Talking Points

- Range trading focuses on buying low and selling high within clearly defined price boundaries

- Trend following is one of the most widely applied forex strategies among retail and professional traders

The foreign exchange (FX) market offers several structural advantages that attract traders worldwide. These include deep liquidity, relatively low transaction costs, flexible margin requirements, and a 24-hour trading session that spans major financial centers such as London, New York, and Tokyo. Because of this continuous market access, traders can apply a wide variety of approaches, ranging from short-term day trading to longer-term position trading.

Within the many styles and methodologies used in forex trading, two strategies stand out as the most common and widely understood: range trading and trend following. These strategies are popular largely because they represent opposite market behaviors. One assumes prices tend to revert to an average, while the other assumes prices tend to continue moving in the same direction.

In this article, I will walk you through these two core forex trading strategies in a clear and practical way, as if we were discussing them in a classroom setting for beginner traders.

Range Trading Strategy in Forex Markets

Range trading is a relatively straightforward forex strategy based on the idea that price often moves between identifiable upper and lower boundaries. In simple terms, traders aim to buy at lower prices and sell at higher prices within a defined range.

This approach is closely related to the concept of mean reversion, where price is expected to return toward its historical average over time. In that sense, range trading shares similarities with value-based investing concepts commonly discussed in traditional financial markets.

Forex Strategy: How to Trade Price Ranges Effectively

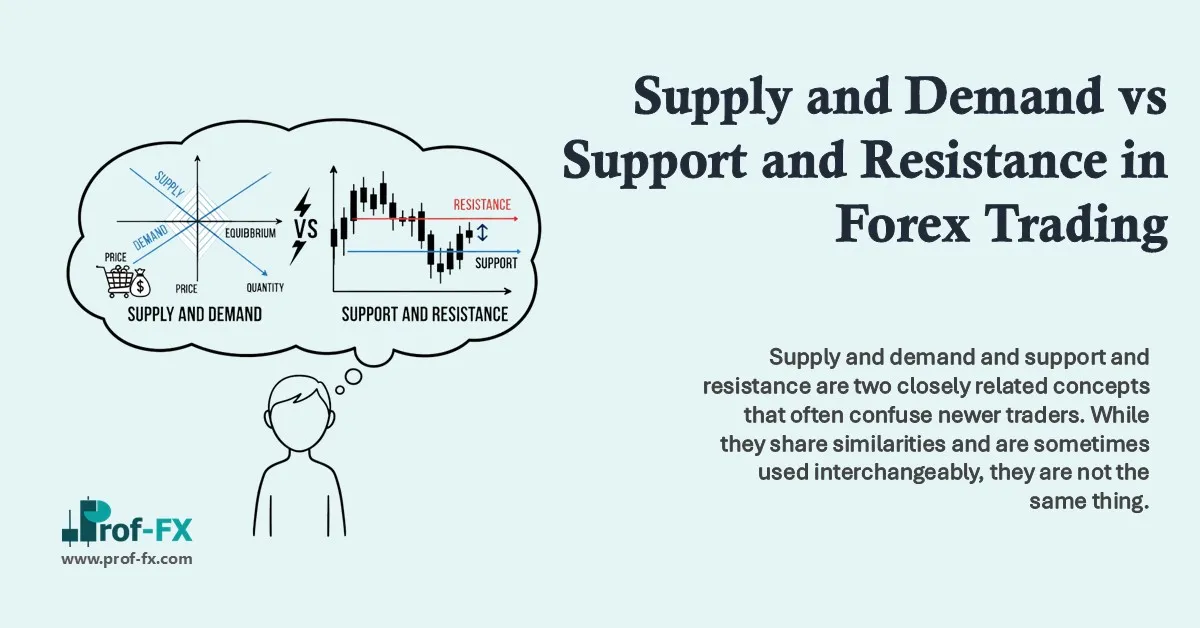

The foundation of successful range trading lies in identifying high-probability price levels. These are areas where selling pressure tends to weaken and buying interest begins to emerge, or vice versa. In forex trading, these zones are commonly referred to as support and resistance levels.

- Support represents a price level where demand is strong enough to prevent further declines.

- Resistance represents a price level where selling pressure limits further price advances.

These levels are typically identified using technical analysis, which may include chart patterns, historical price action, and widely used indicators such as oscillators. Tools like RSI, Stochastic Oscillator, or moving averages can help traders better time their entries and exits within a range.

Range trading is often well-suited for sideways or consolidating markets, where price lacks a strong directional trend. This market condition frequently occurs during periods of low volatility or when major economic data from entities such as central banks, economic institutions, or liquidity providers is absent.

For a deeper practical explanation of this approach, traders can explore James Stanley’s recent publication on range-based forex strategies.

Trend Following: Trading in the Direction of the Market

The second major forex trading strategy is trend following, which is one of the most widely used approaches by both beginner and experienced traders.

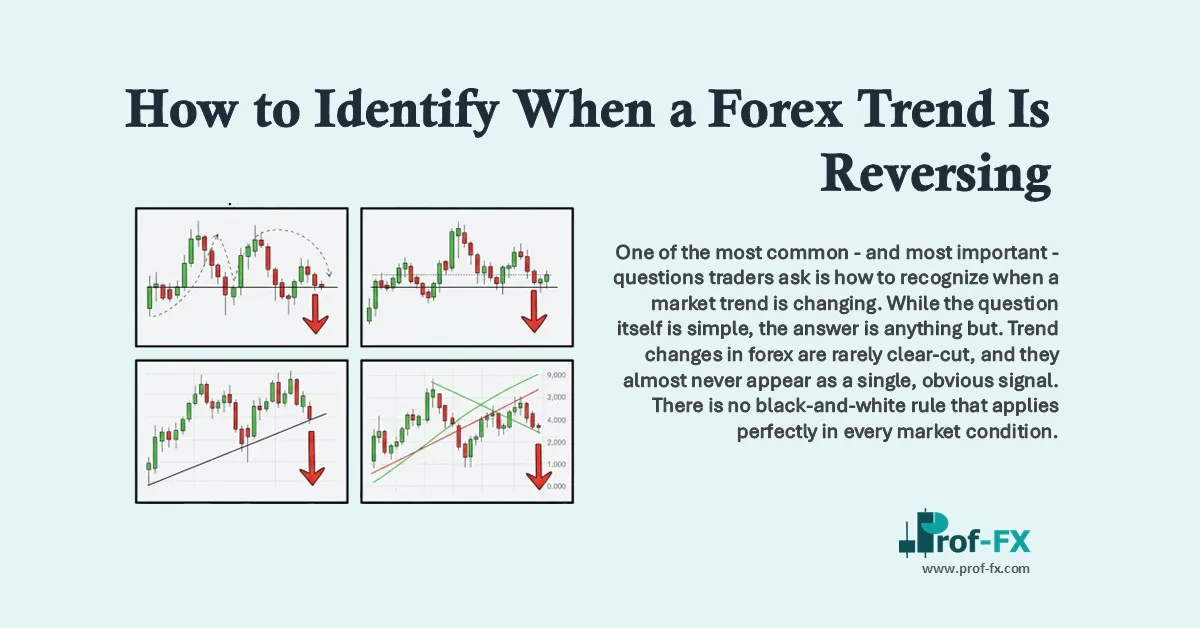

Trend following is based on a simple principle: identify the overall direction of the market and trade in that same direction. If prices are generally moving higher, traders look for buying opportunities. If prices are moving lower, traders focus on selling opportunities.

Forex Strategy: Trading Strong Trends with Confidence

Trend trading is popular because strong trends often produce the largest and most sustained price movements. Historically, many of the most profitable trades in the FX market have occurred when traders aligned themselves with the dominant market trend rather than trying to predict reversals.

Some of the main advantages of trend trading include:

- Clear directional bias, which reduces decision-making complexity

- Higher probability trades during strong momentum phases

One reason trend following is so appealing to new traders is its simplicity. Identifying a trend does not require complex models. Basic tools such as trendlines, moving averages, or higher-high and higher-low price structures can already provide valuable insight.

This simplicity is also why trend analysis is a core component of many professional trading plans used by institutional traders, hedge funds, and algorithmic trading systems.

If you are interested in applying this strategy but are unsure how to begin, it is worth exploring which of the three primary methods for trading strong forex trends best matches your trading personality, risk tolerance, and time commitment.

Final Thoughts for Beginner Forex Traders

Both range trading and trend following are foundational strategies in forex trading education. Neither approach is inherently better than the other. Instead, their effectiveness depends on market conditions, risk management, and the trader’s personal discipline.

As a beginner, the most important step is not choosing the “perfect” strategy, but rather understanding how each strategy works, when it is most effective, and how it fits into a structured trading plan. Over time, experience and consistent analysis will help you determine which approach aligns best with your goals in the global FX market.