Understanding and managing forex spreads is a critical skill for every trader, especially beginners. This article explores effective forex spread trading strategies and practical tips that help traders protect themselves from the risks associated with widening spreads, which can significantly increase trading costs and account risk.

What Is a Forex Spread?

The forex spread is the difference between the bid price (sell) and the ask price (buy) of a currency pair. It represents the primary transaction cost in forex trading. Depending on market conditions, the spread can either narrow or widen, directly impacting profitability.

Spreads are not static. They fluctuate due to factors such as volatility, liquidity, market sessions, and economic news releases—all of which traders must understand to trade more effectively.

Beware of Widening Spreads in Forex Trading

Every forex trader should remain constantly aware of spread behavior. A wider spread means higher trading costs, which can erode profits or amplify losses.

Periods of high volatility or low liquidity, especially when combined with leverage, can be particularly dangerous. The higher the leverage used, the more significant the spread cost becomes relative to account equity. For this reason, many professional traders recommend using low or moderate leverage, especially in uncertain market conditions.

Beginner traders are especially vulnerable. With a small account size, taking a position that is too large can result in a margin call or even automatic position closure if the spread widens unexpectedly.

To reduce these risks, the following three forex spread trading strategies form a strong foundation for consistent trading:

- Monitor factors that influence spread size

- Trade high-liquidity currency pairs

- Choose the optimal time of day to trade

1) Monitor the Key Factors That Affect Forex Spreads

To avoid excessive spread costs, traders should closely monitor the following factors:

Market Volatility

Sudden price movements caused by economic data releases or breaking news can trigger spreads to widen rapidly.

Market Liquidity

Low liquidity often leads to wider spreads. Liquidity and volatility are closely related—illiquid markets tend to experience sharper price swings. Emerging market currencies are particularly known for higher spreads due to lower trading volume.

Spreads and Economic News

Ahead of major economic events—such as the Non-Farm Payrolls (NFP) release—liquidity providers often widen spreads to manage risk. In most cases, spreads normalize shortly after the event passes.

For traders not actively trading the news, patience is key. Waiting for the spread to revert to its normal range can significantly reduce unnecessary trading costs.

2) Trade High-Liquidity Forex Pairs

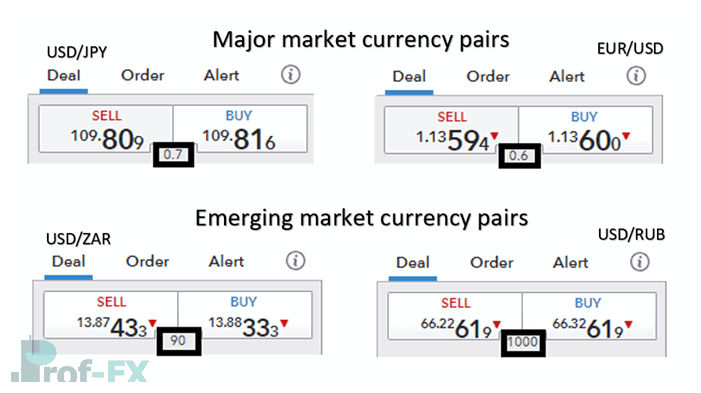

Another effective spread trading strategy—especially for beginners—is to focus on high-liquidity currency pairs. Under normal market conditions, these pairs typically have the tightest spreads.

Major currency pairs include:

- EUR/USD (Euro / US Dollar)

- USD/JPY (US Dollar / Japanese Yen)

- GBP/USD (British Pound / US Dollar)

- USD/CHF (US Dollar / Swiss Franc)

These pairs trade in very high volumes, which usually results in lower spreads. However, even major pairs can experience temporary spread widening during volatile periods or major news releases.

In contrast, emerging market currencies such as:

- USD/MXN (US Dollar / Mexican Peso)

- USD/ZAR (US Dollar / South African Rand)

- USD/RUB (US Dollar / Russian Ruble)

generally have much wider spreads. When trading these pairs, it is prudent to use minimal leverage or no leverage at all.

In the example below, the black boxes highlight the spread differences. Major pairs like USD/JPY and EUR/USD show narrow spreads of approximately 0.7 pips and 0.6 pips, while emerging market pairs such as USD/ZAR and USD/RUB display significantly wider spreads.

3) Time-of-Day Trading and Its Impact on Spreads

The time of day plays an important role in determining forex spreads. During major trading sessions—London, New York, Tokyo, and Sydney—spreads are typically lower due to higher market participation.

The most liquid period in forex trading occurs when the London and New York sessions overlap. During this window, spreads often tighten further as trading volume peaks.

The chart below shows session overlap hours in Eastern Time, with the London–New York overlap occurring roughly between 8:00 AM and 11:00 AM ET.

Timing becomes even more important when trading emerging market currencies, as spreads can expand dramatically outside their local market hours. Traders should plan to trade these currencies during their primary trading sessions when liquidity is highest.

Forex Spread Trading Example Using USD/JPY

By combining the strategies discussed above, traders can significantly reduce the risk of trading at unfavorable spread levels. It is important to remember that spreads can change both at trade entry and exit, so awareness must be maintained throughout the entire trade lifecycle.

Let’s consider a practical example using USD/JPY, one of the most liquid forex pairs.

Monitor Spread-Influencing Factors

Before trading USD/JPY, traders should check for any high-impact economic events or unexpected news that could increase volatility. This can be done by regularly consulting an economic calendar.

Events classified as high impact—such as:

- GDP releases

- CPI (inflation data)

- NFP (Non-Farm Payrolls)

have a higher probability of causing spread widening. Unless the strategy involves trading these events directly, it is generally safer to avoid entering trades during these periods.

Consider the Best Time to Trade USD/JPY

USD/JPY is highly liquid during:

- The London–New York overlap

- The Tokyo session

These periods offer tighter spreads and more stable execution. In contrast, emerging market currencies should only be traded during their local market hours to avoid excessive spread costs.

Final Thoughts for Forex Traders

Forex spread trading is not about eliminating spreads—this is impossible—but about managing them intelligently. By understanding what drives spreads, choosing liquid currency pairs, trading during optimal market hours, and avoiding unnecessary leverage, traders can significantly improve their long-term performance.

For beginners, mastering spread awareness is one of the fastest ways to reduce avoidable losses and build a more professional trading approach.

Additional Resources to Strengthen Your Forex Knowledge

If you are new to forex trading:

- Download our Forex Trading for Beginners Guide to build a strong foundation

- Register for our live trading webinars, covering topics such as central bank decisions, currency news, and technical chart patterns

A solid understanding of spreads, combined with disciplined risk management, is a key step toward consistent and sustainable forex trading success.