Forex sentiment analysis is a powerful complementary tool that helps traders better understand price behavior through market psychology. While solid technical analysis and fundamental analysis remain the foundation of successful trading, sentiment analysis adds another important layer: insight into how the majority of market participants are positioned and thinking.

In this article, I will walk you through what market sentiment is, how sentiment analysis applies to forex trading, and which sentiment indicators professional traders rely on most. I will present this topic as I would to beginner forex traders—clear, structured, and practical—while maintaining professional depth and accuracy.

Understanding Market Sentiment in Financial Markets

Market sentiment refers to the overall attitude, emotion, or consensus of investors and traders toward a specific financial market or instrument. In the forex market, sentiment reflects whether participants broadly expect a currency to strengthen or weaken.

When the market consensus becomes optimistic, sentiment turns positive. Conversely, when fear, uncertainty, or pessimism dominate, sentiment shifts negative. From a trading perspective, sentiment helps define whether a market environment is bullish—characterized by rising prices—or bearish, where prices tend to decline.

Forex traders can assess market sentiment in several ways. Some rely on sentiment indicators, while others observe price action, volatility, and positioning behavior across currency pairs. The key is not to replace technical or fundamental analysis, but to use sentiment as a confirmation or warning signal within a broader trading strategy.

What Is Sentiment Analysis in Forex Trading?

Sentiment analysis in forex trading involves studying how traders are positioned in currency pairs and how collective behavior may influence future price movements. Although sentiment analysis is widely used across equities, commodities, and cryptocurrencies, it plays a particularly important role in the highly liquid and speculative forex market.

Many professional traders—especially contrarian investors—pay close attention to sentiment extremes. When the majority of traders are aggressively buying a currency pair, contrarians may begin looking for signs of exhaustion and prepare to trade in the opposite direction. The logic is simple: once most participants are already positioned, there may be fewer traders left to push the trend further.

How Forex Sentiment Analysis Works in Real Market Conditions

A clear real-world example of sentiment-driven price movement occurred in GBP/USD during 2016. Following Britain’s referendum to leave the European Union (Brexit), market sentiment toward the British pound turned sharply negative. As a result, GBP collapsed to a 31-year low, reflecting extreme bearish sentiment.

In the following year, sentiment gradually improved, supporting a period of recovery. However, negative sentiment returned throughout much of 2018, before the pair began trending higher again in 2019 as market expectations stabilized. This cycle illustrates how shifts in sentiment can drive long-term trends in currency markets.

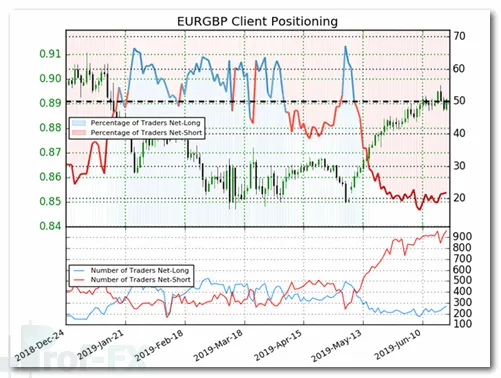

Another practical example can be observed in EUR/GBP sentiment positioning. In one instance, only 21.9% of traders were net-long, while the ratio of short to long positions stood at 3.58 to 1. This imbalance suggested strong bearish sentiment toward the pair.

In such situations, rising sentiment in one direction can signal vulnerability. If too many traders are positioned on the same side of the market, price may struggle to continue in that direction. Experienced sentiment traders often watch for price reversals, failed breakouts, or momentum divergence under these conditions.

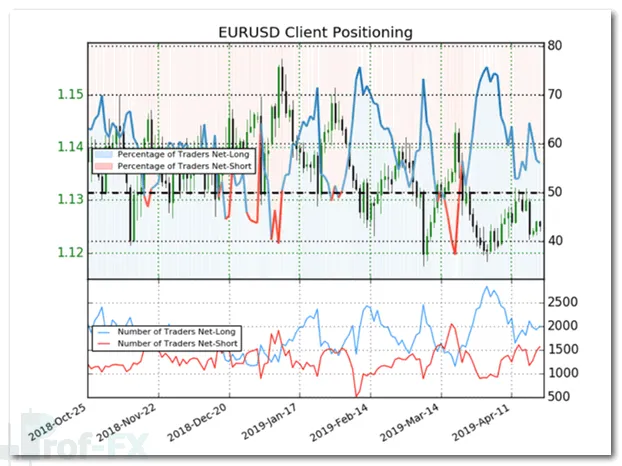

Similarly, when a currency pair such as EUR/USD shows persistently positive sentiment while price action begins to weaken, traders may interpret this as a warning that the trend is approaching a potential turning point.

Using Sentiment Indicators in Forex Trading

Sentiment indicators translate trader positioning and behavior into numeric or visual data, making it easier to interpret market psychology. These indicators often show the percentage of traders holding long or short positions in a particular currency pair.

For example, if 70% of traders are long and 30% are short, the data suggests bullish sentiment. However, from a contrarian perspective, such an imbalance may also hint at overcrowded positioning, which can increase the risk of a reversal.

Among the many sentiment tools available, two stand out as particularly valuable for forex traders: IG Client Sentiment and the Commitment of Traders (COT) Report.

IG Client Sentiment: Tracking Retail Trader Positioning

IG Client Sentiment is widely used by professional traders to monitor real-time long and short positioning among retail market participants. This indicator provides a clear snapshot of how traders are currently positioned across major and minor currency pairs.

By analyzing changes in positioning rather than static numbers alone, traders can identify potential turning points in sentiment. For example, a rapid increase in long positions during a downtrend may suggest emotional buying and reinforce a bearish bias.

Used correctly, IG Client Sentiment can enhance trend confirmation, improve trade timing, and help traders avoid entering overcrowded trades.

Commitment of Traders (COT) Report: Institutional Market Insight

The Commitment of Traders (COT) Report, published weekly by the Commodity Futures Trading Commission (CFTC), offers a broader view of market sentiment by categorizing positions held by different types of traders, including commercial hedgers, large speculators, and non-reportable traders.

Released every Friday at 15:30 Eastern Time, the COT report is especially valuable for identifying longer-term sentiment trends in currency futures markets. While it is not designed for short-term trading signals, it provides important context for understanding how institutional players are positioned.

Expanding Your Understanding of Market Sentiment

To deepen your knowledge of sentiment-driven market behavior, it is also helpful to understand broader risk dynamics such as Risk-On and Risk-Off sentiment, which influence capital flows across forex, equities, bonds, and commodities.

Monitoring sentiment across related markets—such as interest rates, equity indices, and safe-haven assets—can further strengthen your ability to interpret price movements in major currency pairs like EUR/USD, GBP/USD, USD/JPY, and AUD/USD.

Prof FX provides forex news, market sentiment insights, and technical analysis focused on the key trends shaping the global currency markets. By combining sentiment analysis with disciplined technical and fundamental approaches, traders can develop a more complete and resilient trading framework.