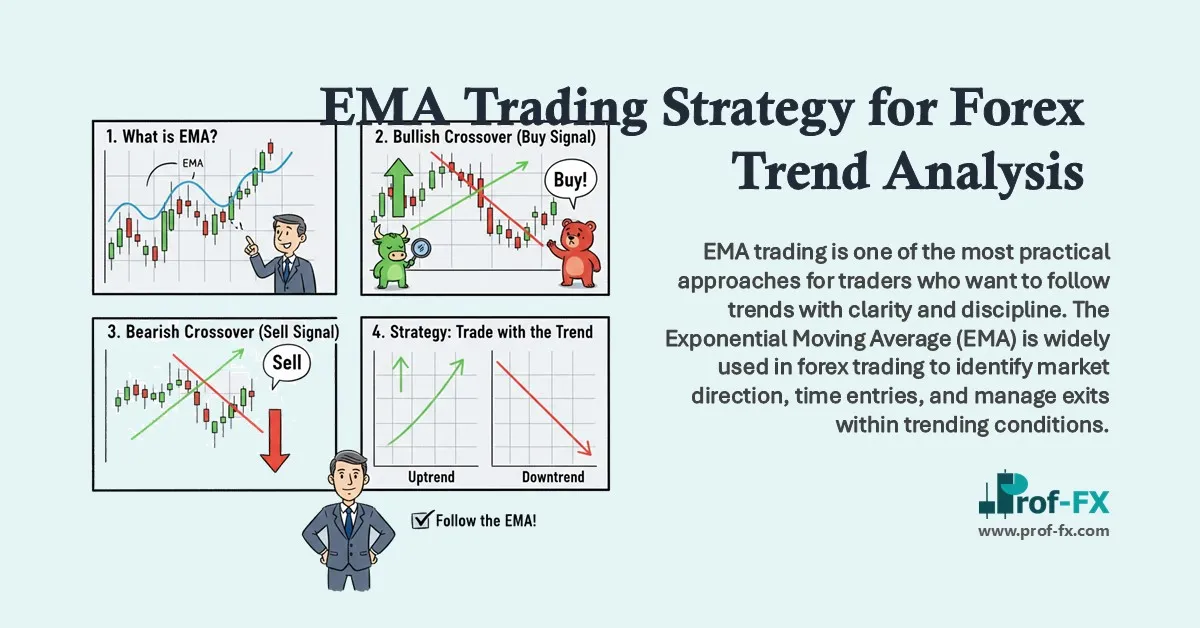

EMA trading is one of the most practical approaches for traders who want to follow trends with clarity and discipline. The Exponential Moving Average (EMA) is widely used in forex trading to identify market direction, time entries, and manage exits within trending conditions.

In this guide, I will explain what EMA means in forex trading and walk you through a three-step EMA trading strategy designed to help traders build a complete and structured trend-following approach.

EMA Trading Overview

Trend trading offers traders multiple strategic options, but success depends on using tools that respond efficiently to price movement. EMA stands out because it reacts faster to recent price changes compared to traditional moving averages.

This article focuses on how EMAs can be applied in a systematic way to:

- Identify forex trends

- Time trade entries

- Define exit points and manage risk

What Is EMA in Forex Trading?

The Exponential Moving Average (EMA) is a refined version of the Simple Moving Average (SMA). Like the SMA, EMA plots an average price over a selected period directly on the chart. The key difference lies in its calculation.

EMA assigns greater weight to the most recent price data. This adjustment reduces lag, allowing traders to respond more quickly to changes in market momentum. Because of this responsiveness, EMA is particularly effective in trending markets, making it a popular indicator among both short-term and long-term forex traders.

EMA indicators are available on virtually all charting platforms and are commonly used to support trend identification, entry timing, and exit management.

Three-Step EMA Trading Strategy

The EMA strategy outlined below uses a combination of exponential moving averages to guide the entire trade process. While the methodology is simple, it provides structure and consistency—two critical elements for trading success.

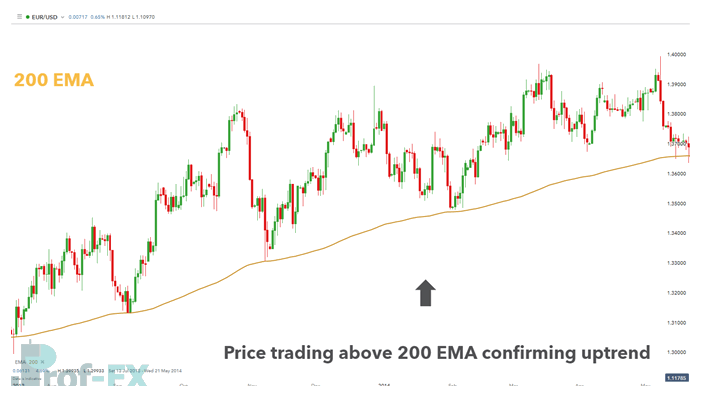

Step 1: Identify the Trend in Your Forex Pair

Before placing any trade, traders must first confirm market direction. Trend confirmation reduces the likelihood of trading against momentum.

In the example below, the EUR/USD daily chart shows a series of higher highs and higher lows—classic characteristics of an uptrend. To confirm this observation, a 200-period EMA is applied.

Traditionally:

- Price above the 200 EMA signals a bullish trend

- Price below the 200 EMA signals a bearish trend

This long-term EMA acts as a trend filter, helping traders align their bias with dominant market direction.

EUR/USD trend analysis:

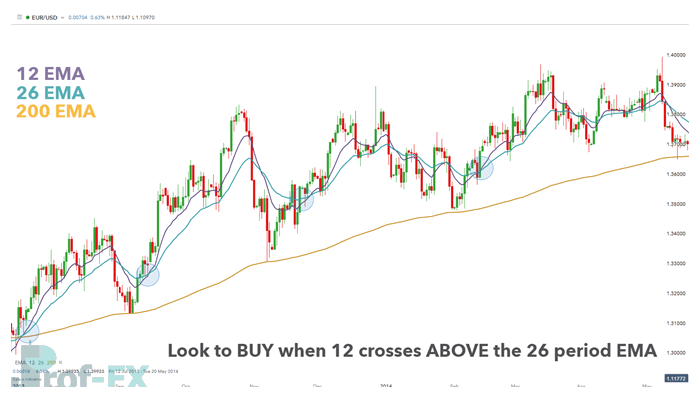

Step 2: Use EMA to Time Trade Entries

Once the trend is established, traders can focus on precise entry timing. For this step, a 12-period EMA and 26-period EMA are added to the chart.

In an uptrend, traders are not chasing price. Instead, they wait for momentum to realign with the trend. This occurs when:

- The 12 EMA crosses above the 26 EMA

This crossover indicates renewed bullish momentum and provides a potential buy signal. Traders can then look for confirmation using price action or additional indicators if desired.

The same logic applies in a downtrend, where traders look to sell when the 12 EMA crosses below the 26 EMA.

EUR/USD EMA entry examples:

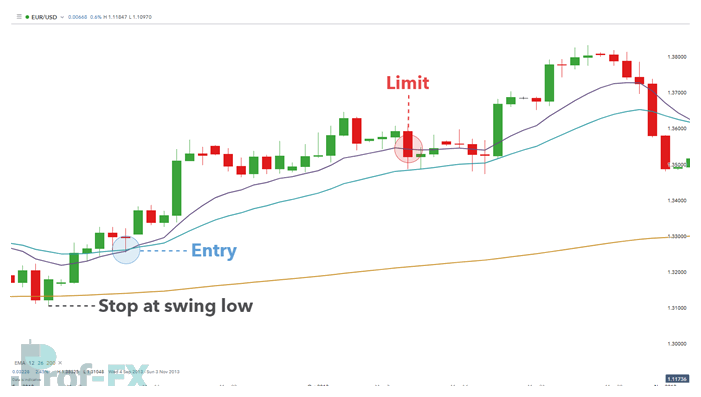

Step 3: Use EMA to Identify Exit Points

After entering a trade, managing exits becomes the final and most important step. EMA can also assist traders in identifying when momentum begins to weaken.

In an uptrend, traders enter on bullish momentum and should consider exiting when that momentum fades. One practical approach is to close positions when price pulls back and touches the 12-period EMA.

Risk management should always accompany exit planning. A commonly used method is placing stop losses below a recent swing low in an uptrend (or above a swing high in a downtrend). This allows traders to exit efficiently if the trend structure breaks.

The example below demonstrates how EMA-based exits and swing-based stop placement work together.

EUR/USD exit strategy example:

EMA Trading Strategy Summary

EMA trading offers a complete and structured approach to trend trading. With a single indicator set, traders can:

- Identify market trends

- Time entries with momentum

- Manage exits and risk

Although EMA may initially appear complex, its application is straightforward when used systematically. This simplicity makes EMA an effective tool for both novice traders learning trend dynamics and experienced traders refining execution.

Expand Your Trading Skills with Prof FX

EMA is just one of many powerful technical indicators available to forex traders. To deepen your understanding:

- Explore our guide to the most popular technical indicators

- Learn more about exponential moving averages (EMA) and how they are calculated

- Study the simple moving average (SMA) and how to apply the 200-day moving average in trading strategies

About Prof FX

Prof FX provides professional forex news, technical analysis, and educational resources focused on the trends shaping the global currency markets. Our mission is to help traders build disciplined, structured, and sustainable trading strategies.