Understanding Common Forex Trading Mistakes and Why They Matter

Human error is unavoidable in the forex market, especially among new traders. In fact, most trading losses are not caused by a lack of indicators or market access, but by repeated behavioral mistakes that slowly erode trading accounts. While even experienced traders make errors, understanding why these mistakes occur is the first step toward limiting their long-term impact.

Forex trading is a continuous learning process. Traders who regularly identify, review, and correct their mistakes are far more likely to survive and grow in the market. This guide outlines 10 of the most common forex trading mistakes and explains how traders can avoid them through discipline, planning, and proper risk management.

It is important to accept that losses are part of trading. However, many losses can be minimized—or avoided entirely—by eliminating preventable human errors.

Mistake 1: Trading Without a Clear Trading Plan

One of the most damaging mistakes in forex trading is operating without a trading plan. Traders who lack structure often trade impulsively, switching strategies mid-trade and reacting emotionally to market fluctuations.

A well-defined trading plan provides:

- Clear entry and exit rules

- Risk management guidelines

- Consistency across trades

Without this structure, traders expose themselves to irrational decisions during adverse market movements. Every trading strategy should be tested on a demo account before being applied to a live account. Once the strategy is understood and consistently executed, it can then be transitioned to real capital.

Mistake 2: Over-Leveraging Trading Positions

Leverage allows traders to control larger positions using borrowed capital. While this can amplify profits, it also magnifies losses. Over-leveraging is one of the fastest ways to destroy a trading account.

Many brokers offer extremely high leverage ratios—sometimes as high as 1000:1—which significantly increase risk, especially for inexperienced traders. Reputable and regulated brokers limit leverage in line with guidelines set by authorities such as the FCA, CFTC, and ESMA.

Understanding how leverage works—and using it conservatively—is essential for long-term survival in the forex market.

Mistake 3: Ignoring the Appropriate Time Horizon

Every trading strategy operates within a specific time horizon. Problems arise when traders mismatch strategies with unsuitable timeframes.

For example:

- Scalpers focus on very short-term price movements

- Day traders operate within intraday timeframes

- Position traders hold trades for weeks or months

Failing to align strategy with time horizon leads to confusion, poor decision-making, and emotional stress. Traders should clearly understand the time commitment required for their chosen approach.

Mistake 4: Insufficient Market Research

Successful forex trading requires ongoing technical and fundamental research. Traders who rely on rumors, social media tips, or unverified news expose themselves to unnecessary risk.

Proper research helps traders:

- Identify market trends

- Time entries and exits effectively

- Understand macroeconomic drivers such as interest rates, inflation, and central bank policy

Each currency pair has unique characteristics. For example, EUR/USD, GBP/JPY, and AUD/USD respond differently to economic data and risk sentiment. These nuances must be studied carefully.

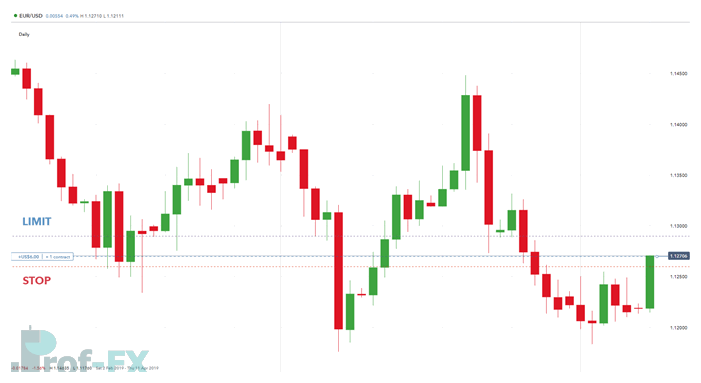

Mistake 5: Poor Risk-to-Reward Ratios

Ignoring risk-to-reward ratios is a critical mistake that often leads to long-term losses—even when traders are right more than 50% of the time.

A positive risk-to-reward ratio, such as 1:2, means that the potential profit is double the potential loss. This structure allows traders to remain profitable even with a moderate win rate.

For example, a long EUR/USD trade risking 10 pips to gain 20 pips reflects disciplined risk management. Tools like the Average True Range (ATR) are commonly used to determine realistic stop-loss and take-profit levels based on market volatility.

Extensive research by Prof FX has shown that poor risk management is the number one mistake made by retail traders.

Mistake 6: Emotion-Based Trading Decisions

Trading driven by fear, frustration, or revenge often leads to irrational decisions. A common emotional mistake is opening additional trades after a loss in an attempt to “recover” quickly.

These trades are usually unsupported by technical or fundamental analysis and violate the trading plan. Emotional trading is precisely why trading plans exist—to protect traders from themselves during periods of stress.

Discipline, not emotion, must guide every trading decision.

Mistake 7: Inconsistent Position Sizing

Position sizing must align with account size and risk tolerance. Many traders risk too much on individual trades, which increases emotional pressure and accelerates losses.

A widely accepted guideline is to risk no more than 2% of account equity per trade. For example, on a $10,000 account, the maximum risk should be approximately $200 per trade.

This approach helps traders stay objective and prevents single trades from wiping out weeks—or months—of progress.

Mistake 8: Trading Too Many Markets at Once

Focusing on a small number of markets allows traders to develop deeper expertise. Many beginners attempt to trade multiple currency pairs, indices, commodities, and cryptocurrencies simultaneously—often without sufficient understanding.

This behavior frequently leads to noise trading, where trades are placed without solid justification. A clear example was the Bitcoin surge in 2018, when many traders entered during the euphoric phase of the market cycle and suffered significant losses.

Mastery comes from focus, not overexposure.

Mistake 9: Failing to Review Past Trades

Without reviewing past trades, traders are unable to identify recurring mistakes or successful behaviors. A trading journal is one of the most powerful tools for long-term improvement.

A well-maintained journal helps traders:

- Identify strategic weaknesses

- Reinforce successful habits

- Remove emotional bias from performance evaluation

Regular review transforms mistakes into valuable learning opportunities.

Mistake 10: Choosing the Wrong Forex Broker

Selecting an unsuitable broker can undermine even the best trading strategy. Traders should prioritize:

- Strong regulation

- Financial stability

- Transparent pricing

Many brokers operate under weak regulatory frameworks to avoid strict oversight found in jurisdictions such as the United States (Commodity Exchange Act) and the United Kingdom (FCA).

Beyond safety, traders should ensure the platform is reliable, user-friendly, and well understood before committing real capital.

Forex Trading Mistakes: Key Lessons for Long-Term Success

Avoiding common forex trading mistakes starts with a solid foundation. A clear trading plan, disciplined risk management, consistent review, and the right broker form the backbone of sustainable trading.

Mistakes are inevitable—but repeating the same mistakes is optional. Traders who actively work to minimize errors and reinforce best practices give themselves a meaningful edge in the market.

Continue Learning with Prof FX

- If you are new to forex, explore our comprehensive New to Forex guide

- Discover insights from our analysis of over 30 million live trades in the Traits of Successful Traders research

- Use retail client sentiment data, including IG client sentiment, to enhance market perspective

Prof FX provides forex news, technical analysis, and educational content focused on the forces shaping global currency markets—helping traders make more informed, disciplined decisions.