Understanding What a Pip Means in the Forex Market

In forex trading, the term PIP—short for Point in Percentage—refers to the standard unit of measurement used to express price changes between two currencies. For most major currency pairs, a pip represents a one-digit movement in the fourth decimal place of a forex quote.

As a professional trader, this is one of the very first concepts I explain to beginner traders, because every profit, loss, stop loss, and take profit level is measured in pips.

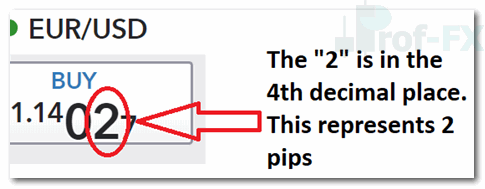

A Simple Pip Example Using EUR/USD

If the EUR/USD exchange rate moves from 1.1402 to 1.1403, that price change equals one pip.

This may look insignificant, but when combined with position size (lot size), that single pip can represent real monetary gain or loss.

Example: Buying EUR/USD and Pip Movement

Even though a pip is a small price increment, it plays a critical role in risk management, position sizing, and performance evaluation in forex trading.

Are All Forex Pips Calculated the Same Way?

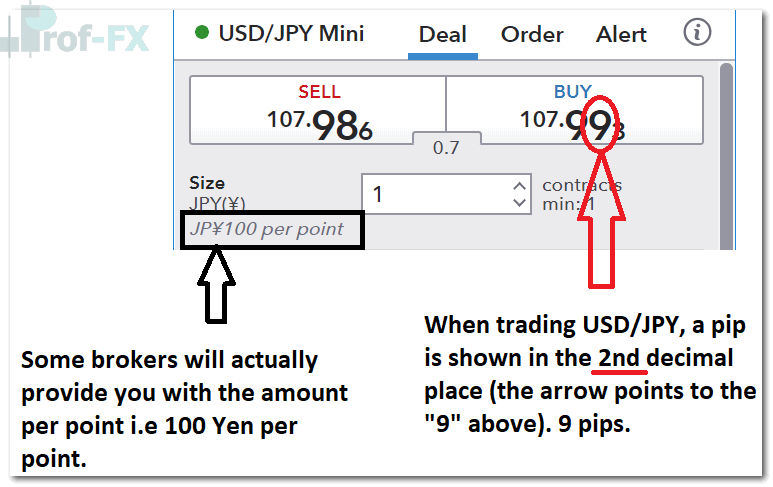

Not all currency pairs use the fourth decimal place to define a pip. The most important exception involves currency pairs that include the Japanese Yen (JPY).

Before diving into pip calculations, it’s essential to understand how pip values work across different pairs and why they matter.

Why Pip Definitions Differ Across Currency Pairs

Not all currency pairs use the fourth decimal place to define a pip, and this distinction is critical for anyone serious about forex trading. While most major currency pairs—such as EUR/USD, GBP/USD, and AUD/USD—quote prices to four decimal places, the most important and widely traded exception involves currency pairs that include the Japanese Yen (JPY).

This difference exists because the Japanese Yen has a significantly lower face value compared to major Western currencies like the US Dollar, Euro, or British Pound. As a result, JPY-based currency pairs are quoted using two decimal places instead of four, and consequently, one pip equals a movement in the second decimal place, not the fourth.

Understanding this structural difference is not just a technical detail—it directly impacts pip value calculations, risk management, and trade sizing.

Why Pip Structure Matters for Real Trading Decisions

Before diving into pip calculations, it’s essential to understand how pip values vary across different currency pairs and why those differences matter in practice.

Each currency pair behaves differently due to:

- Variations in exchange rate magnitude

- Differences in quote currency denomination

- Market liquidity and volatility characteristics

- The base and quote currency relationship

Because pip value is always expressed in the quote currency, a one-pip movement does not carry the same monetary impact across all currency pairs, even when trading the same lot size.

For example:

- A 10-pip move in EUR/USD does not equal the same monetary gain or loss as a 10-pip move in USD/JPY

- Trading the same position size across different pairs can produce very different risk exposures

This is why professional traders never assume pip values—they calculate them for each specific pair before entering a trade.

The Practical Impact on Risk and Trade Management

Failing to understand how pip definitions differ can lead to:

- Miscalculated stop loss distances

- Inaccurate risk-to-reward ratios

- Oversized or undersized positions

- Unexpected account drawdowns

For beginner traders especially, recognizing that not all pips are created equal is a major step toward trading with structure and discipline rather than guesswork.

Once this foundation is clear, calculating pip values—whether for standard lots, mini lots, or different account currencies—becomes far more intuitive and precise.

How to Calculate the Value of a Pip in Forex Trading

The pip value tells you how much money you gain or lose when the market moves by one pip. This value depends on two key factors:

- The currency pair being traded

- The lot size (contract size)

The General Pip Value Formula

Pip Value = Contract Size × One Pip

For most currency pairs:

- One pip = 0.0001

Standard vs Mini Forex Contracts

Forex brokers typically offer predefined contract sizes:

| Contract Type | Contract Size (Base Currency Units) |

| Standard Lot | 100,000 units |

| Mini Lot | 10,000 units |

Pip Value Calculation Example: EUR/USD

Let’s walk through a practical example using EUR/USD, one of the most actively traded major currency pairs.

Standard Lot Pip Value (EUR/USD)

- Contract size: 100,000

- One pip: 0001

Calculation:

Pip Value = 100,000 × 0.0001

Pip Value = $10

This means:

- A +1 pip move = $10 profit

- A -1 pip move = $10 loss

Mini Lot Pip Value

For a mini lot:

- 10,000 × 0.0001 = $1 per pip

Understanding this relationship allows traders to quantify risk, rather than guessing based on pip distance alone.

Why Pip Value Matters for Risk Management

Professional traders never think only in pips—they think in money.

By calculating pip value accurately, traders can:

- Set stop loss levels with precision

- Define take profit targets realistically

- Understand how price movement affects account equity

- Maintain consistent risk-to-reward ratios

This is a core principle taught in institutional trading desks, prop firms, and professional forex education.

Pip Value Depends on the Quote Currency

It’s important to remember that pip value is always denominated in the quote (counter) currency of the pair.

Examples:

- EUR/USD → pip value in USD

- GBP/JPY → pip value in JPY

- AUD/USD → pip value in USD

Because exchange rates differ, pip values are not universal across currency pairs.

Converting Pip Value to Your Account Currency

If your trading account is not denominated in USD, pip values must be converted.

Example: EUR/USD Pip Value in a GBP-Based Account

Assume:

- Mini lot EUR/USD pip value = $1

- Current GBP/USD exchange rate = 2863

Because the British Pound is stronger than the US Dollar, we divide:

$1 ÷ 1.2863 = £0.7774

So, for a GBP-based account:

- One pip gain or loss on a 10k EUR/USD trade equals £0.7774

This conversion step is essential for traders operating accounts in GBP, EUR, AUD, or other base currencies.

The Exception: Understanding USD/JPY Pip Calculations

Currency pairs involving the Japanese Yen (JPY) are quoted differently due to the yen’s lower relative value.

Why JPY Pairs Are Different

For JPY pairs:

- One pip = movement in the second decimal place

- Example: USD/JPY moves from 99 to 108.00

That move equals one pip, not 0.0001.

USD/JPY Price Example

Pip Value for USD/JPY Contracts

- Mini lot (10,000 units): ¥100 per pip

- Standard lot (100,000 units): ¥1,000 per pip

This difference often confuses beginners, but once understood, it becomes second nature in live trading.

Key Takeaways for Beginner Forex Traders

As someone with over 15 years of experience in forex markets, here are the essential points to remember:

- A pip is the foundation of price movement in forex

- Pip value depends on lot size and currency pair

- JPY pairs use the second decimal place

- Pip calculations help traders control risk and protect capital

- Always think in monetary terms, not just pips

Mastering pips is not optional—it is a core skill for consistent and disciplined forex trading.

Continue Learning Forex Trading Concepts

If you want to deepen your understanding of forex trading, consider expanding your knowledge in areas such as:

- How to read a forex quote

- Position sizing and leverage

- Building a structured forex trading strategy

- Technical and fundamental analysis

- Trading psychology and discipline

Prof FX delivers professional forex news, market insights, and technical analysis focused on the global currency markets, helping traders stay informed and make better trading decisions over the long term.