The Bank of Japan (BoJ) is one of the most influential central banks in the global financial system. As Japan’s monetary authority, the BoJ sets policies designed to maintain price stability and ensure the resilience of the Japanese financial system. Because of Japan’s economic size and the yen’s role as a major and safe-haven currency, decisions made by the BoJ have a direct and often immediate impact on the forex market.

For forex traders, closely following BoJ policy meetings, interest rate decisions, and official communication is essential—particularly when trading JPY pairs such as USD/JPY, EUR/JPY, and GBP/JPY.

This guide explains how the Bank of Japan operates, its key mandates, how monetary policy affects forex trading, and what traders should understand when trading the Japanese yen.

What Is the Bank of Japan (BoJ)?

The Bank of Japan—commonly referred to as Nichigin—is Japan’s central bank. Its primary responsibilities include implementing monetary policy, issuing currency, and maintaining the stability of the financial system.

The BoJ’s Policy Board holds regular monetary policy meetings where it decides on interest rates and other policy tools aimed at influencing inflation, economic growth, and financial conditions. These meetings are closely watched by global investors due to their potential impact on risk sentiment and currency markets.

Who Owns the Bank of Japan?

The ownership structure of the Bank of Japan is unique among major central banks. The Japanese government holds 55% ownership and maintains 100% of the voting rights. The remaining 45% is publicly traded on JASDAQ.

As of August 2019, the Governor of the Bank of Japan was Haruhiko Kuroda, who had held the position since March 2013 and was serving his second five-year term, scheduled to run until April 2023. His tenure is widely associated with aggressive monetary easing and unconventional policy measures.

Key Economic Mandates of Japan’s Central Bank

The Bank of Japan operates under two core mandates:

1. Maintaining Financial System Stability

2. Maintaining Price Stability

These mandates are closely interconnected and guide every major policy decision made by the central bank.

Maintaining Financial System Stability

The BoJ implements monetary policy to preserve the stability of Japan’s financial system. This includes:

- Currency control

- Monetary control

- Issuance of banknotes

Financial system stability supports the broader economy and complements the BoJ’s efforts to achieve price stability. By ensuring confidence in the banking system and liquidity conditions, the central bank aims to create an environment where economic activity can function smoothly.

Maintaining Price Stability

Price stability is the BoJ’s other central objective. Given Japan’s heavy reliance on exports, maintaining stable prices is critical to economic competitiveness.

The Bank of Japan defines price stability as a 2% year-on-year increase in the Consumer Price Index (CPI). However, Japan has struggled with persistently low inflation for decades, often falling short of this target.

To combat deflationary pressures, the BoJ has consistently used ultra-loose monetary policy, including low and negative interest rates, to stimulate spending, investment, and inflation.

How the Bank of Japan Implements Monetary Policy

The BoJ conducts Monetary Policy Meetings (MPMs) eight times per year. These meetings last two days and involve the Policy Board, which consists of:

- The Governor

- Two Deputy Governors

- Six additional board members

During these meetings, decisions are made regarding interest rates and other policy measures. As of July 2018, the BoJ maintained its policy rate at -0.1%, reflecting its continued efforts to stimulate economic growth and inflation.

How Bank of Japan Policy Affects the Japanese Yen (JPY)

Japan’s prolonged battle with low inflation has resulted in one of the most accommodative monetary policy stances among major economies. By keeping interest rates extremely low, the BoJ aims to discourage saving and encourage spending and investment.

This policy stance has had a significant impact on the Japanese yen, which has generally weakened against major currencies such as the US dollar and the euro since Kuroda took office.

For example:

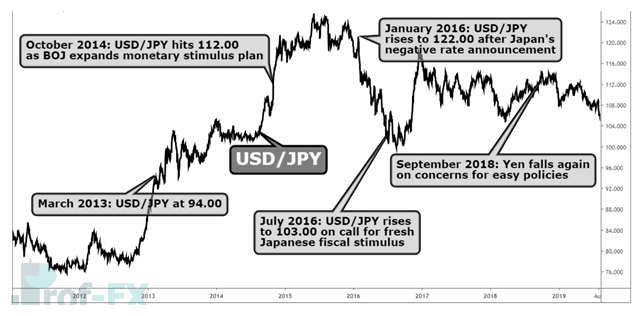

- USD/JPY rose from around 00 in March 2013 to over 125.00 in June 2015 following the announcement of aggressive easing measures.

- Although the pair has fluctuated since then, the yen has remained structurally weaker, with USD/JPY trading near 108.00 in July 2019.

USD/JPY and Major BoJ Announcements

Negative Interest Rates and Market Reactions

After a period of relative yen strength between 2012 and 2013, the currency weakened sharply following Kuroda’s initial policy measures. Another major turning point occurred in January 2016, when the BoJ surprised markets by introducing negative interest rates for the first time, charging -0.1% on bank deposits.

The intention behind this move was to encourage financial institutions to deploy capital into the economy rather than holding idle reserves. The announcement shocked markets, particularly because Kuroda had recently indicated that no policy changes were imminent.

Following the announcement:

- The yen weakened against currencies such as the US dollar and British pound

- Japanese equities, including the Japan 225, rallied sharply

This episode highlighted how unexpected policy decisions can trigger sharp forex and equity market moves.

How to Trade Bank of Japan Interest Rate Decisions

BoJ interest rate decisions aim to stimulate spending and investment, influencing inflation expectations. These changes—along with market anticipation ahead of policy meetings—can create significant trading opportunities in the forex market.

Short-term interest rates are a key driver of currency valuation, making them especially important for JPY traders.

Interest Rate Expectations and FX Impact

| Market Expectations | Actual Outcome | FX Impact |

| Rate Hike | Rate Hold | Currency Depreciation |

| Rate Cut | Rate Hold | Currency Appreciation |

| Rate Hold | Rate Hike | Currency Appreciation |

| Rate Hold | Rate Cut | Currency Depreciation |

As with other central banks, markets react primarily to changes in expectations, not just the policy decision itself.

Improving Trades Around BoJ Decisions

Trading BoJ announcements can be enhanced by:

- Following professional news, analysis, and trading forecasts

- Attending central bank-focused webinars to understand policy trends

- Sticking to a well-defined trading plan, especially during periods of heightened yen volatility

Because JPY can move sharply in either direction, traders must always ensure that risk is controlled and losses are affordable.

Key Takeaways for Forex Traders

The Bank of Japan plays a fundamental role in determining the value of the Japanese yen.

Short-term interest rates are a major factor in currency valuation.

BoJ monetary policy meetings often drive significant JPY volatility.

Understanding the BoJ’s objectives, tools, and communication style is essential for any trader looking to trade yen-based currency pairs effectively.

Prof FX provides professional forex news and technical analysis focused on the trends that influence global currency markets.